Since 1992, NHSSN has enhanced the lives of low-to-moderate-income individuals, families, and communities by providing affordable rental housing, down payment assistance, financial literacy, counseling, and homebuyer education. #NHSSNCARES

NHSSN creates and fosters partnerships with residents, business leaders, and governmental entities. Our goal is to help low to moderate-income individuals and families in Nevada attain affordable housing. We pursue this goal by creating homeownership opportunities through the development of affordable housing, homeownership education, and neighborhood revitalization.

Our vision is to build better neighborhoods block by block.

Homebuyer Solutions

Are you looking to buy a house? Our network of local counselors provide education and assistance for homebuyers so they can confidently purchase homes that are affordable for the long term.

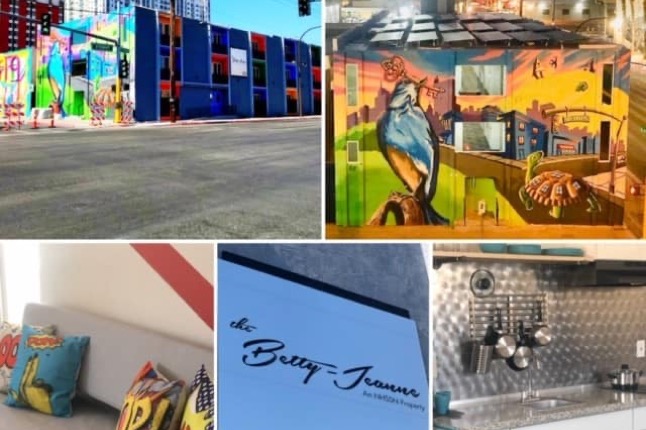

NHSSN Initiatives

Our initiatives work to overcome the lack of affordable housing through the acquisition, renovation and sale of properties to low-to-middle income families in Las Vegas.

Homeowner Solutions

We encourage sustainable homeownership by providing financial literacy, pre-and post-purchase one:one counseling and homebuyer education onsite and online.

Financial Literacy

NHSSN provides tools and resources to help our clients understand and use various financial skills, including personal financial management, budgeting, and investing.

Have a question or comment?

Come to NHSSN Events!

Special Thanks to our Partners